At the time of writing this, Townsville is experiencing a rental crisis.

Since July 2020, the amount of available rental properties has decreased significantly. The average rental property is getting approx. 30+ applications within the first 24 hours of being advertised online, making the rental application process difficult and stressful for all parties involved.

There is no doubt that there is elevated competition when applying for a rental property. Property Managers throughout Townsville are struggling with the inundation of applications, resulting in slower processing times and ultimately upsetting and disappointing 99% of the applicants.

At the end of the day, only one person/family can be approved for one property. The question is, how do YOU become that one person/family?

We are going to discuss what you can do to help make this process easier and help your application stand out amongst the several hundred other applications – because let’s face it, you’re applying for multiple properties at the same time.

This advice and recommendation is provided to you by an industry professional who has significant experience the rental application process both as a renter and a property manager.

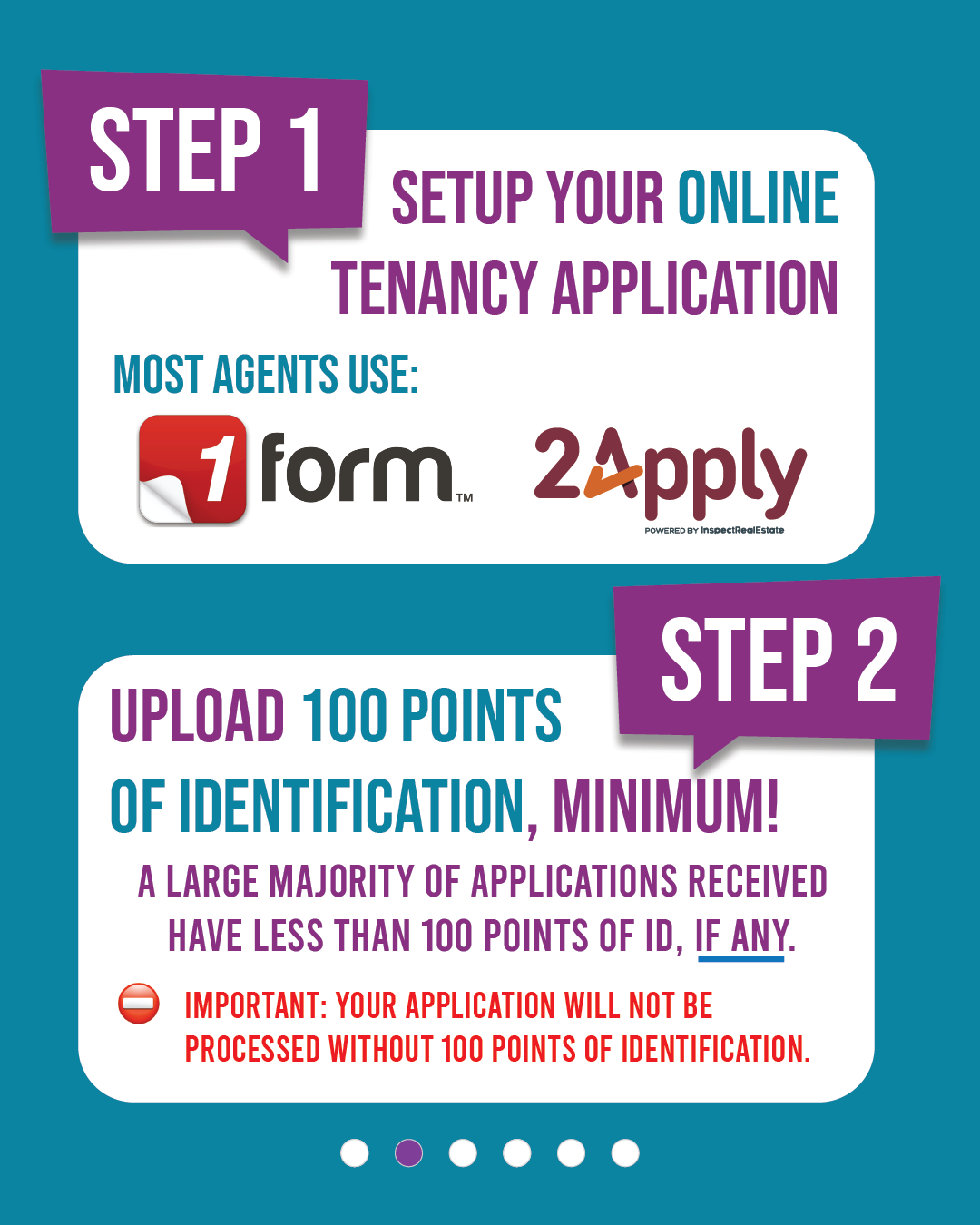

STEP 1: Set up your online application

Almost every real estate agent has gone digital with the application process. Not only does it streamline the workflow, but with the software available, it can automate a significant amount of the application process, speeding your application through the necessary steps.

However, if your online application is not set up correctly, and significant information and documentation is missing, you’re not going to make any progress at all, and your application will come to complete halt.

As a property manager, my all-time favourite application I can receive is one that I can finish processing once I start it – with the only potential delay being responses from Personal, Professional and Rental References.

By taking the time to set up your online application, on multiple platforms, you are increasing the likelihood of your application being processed as soon as it reaches the Property Manager (or Leasing Agent – depending on the agency you’re applying with).

The superior application processing platform is hands down 2Apply. If you are wanting your application to be processed as quickly as possible, we recommend you use this platform.

If you find a property that you are interested in applying for, see if that property is also advertised on the real estate advertising platform Tenants App – if it is, you will be able to apply directly via 2Apply.

2Apply is created by Inspect RealEstate (IRE), who are industry leaders in property management software and provide fantastic industry tools and resources. Unlike Realestate.com.au, they understand what it is like to work within the industry, and customise their software and platforms to work for the Agents.

When applying through 2Apply, the software will be working automatically behind the scenes to collect References for Rental History, Employment, Personal References and Emergency Contacts. Once it has received these, they will be available to all other Agencies you apply with for 30 days before being archived, which makes applying for several properties easy and fast.

Unfortunately, Ignite (created by Realestate.com.au) does not integrate with 2Apply, nor does it allow Agents to create custom tenancy application forms meeting Agency application requirements (and Lessor Insurance Requirements). This results in applications being lodged via Ignite often being incomplete, delaying the ability for the application to be processed by the Agent. Despite a majority of Agencies raising this issue with Ignite, they are not interested in making any changes to their software.

STEP 2: Provide ALL required supporting documents (and then some!)

Your job as the applicant is to prove to the Agent (or Landlord) that you are a Low-Risk tenant who can pay their rent on time and maintain the property. There is no such thing as too much supporting documentation to prove this… but don’t take this as an opportunity to bombard your PM with too much information that they take forever to get through it all.

So what is the right amount? Well, this isn’t as easy to answer as the required documents for an application are based on your personal (and your households) circumstances.

However, there are most definitely the bare minimum required documents that you MUST provide, NO MATTER WHAT.

Reminder: each real estate or private landlord will have their own criteria for this, however if you follow our instructions and recommendations, you may find that you meet their criteria instantly!

BONUS STEP (optional): combine all of the above into one PDF file.

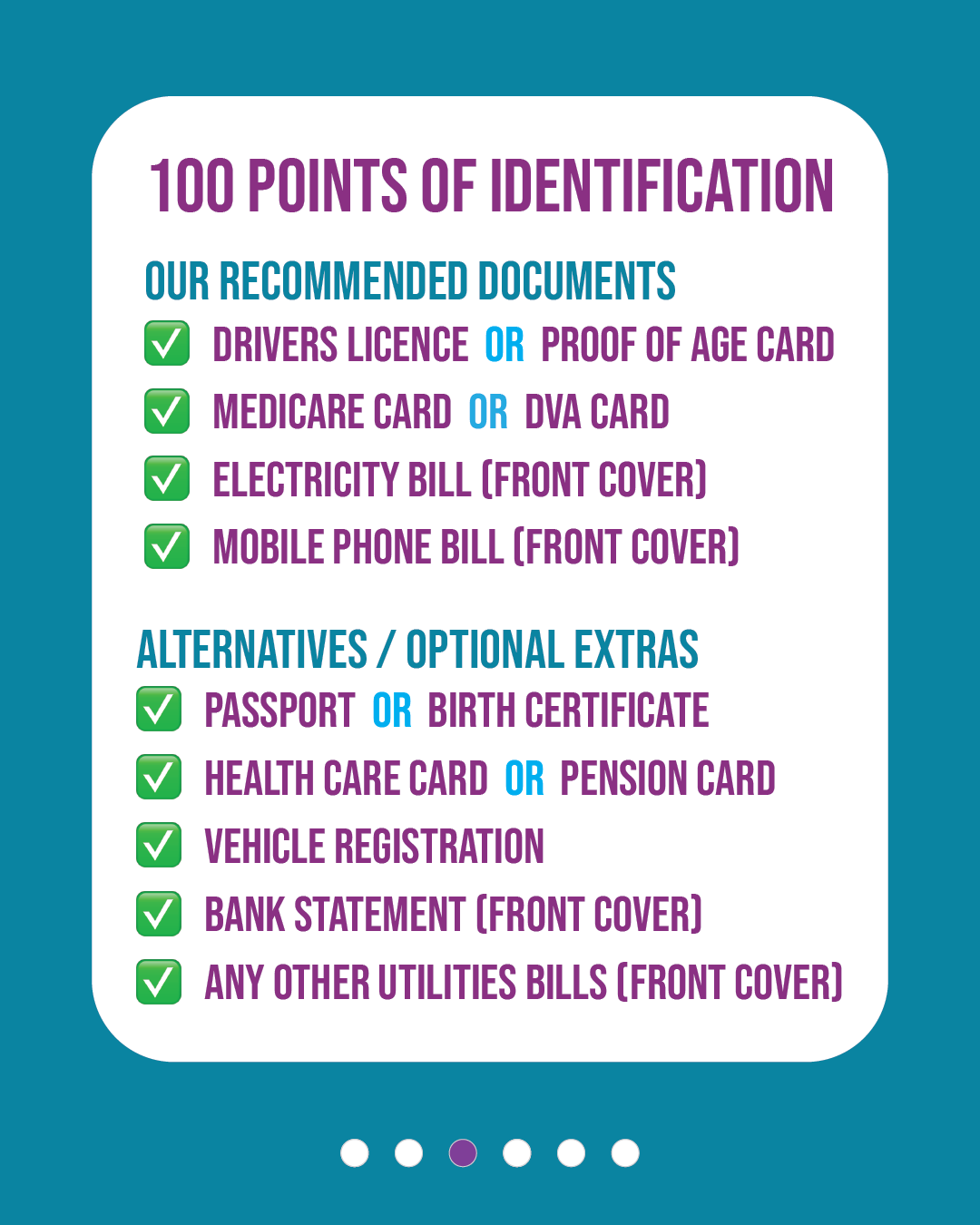

100 Points of ID

You need to provide a minimum of 100 points of Identification with your application. THIS IS A MUST!

Here is what we (and every other property manager in Townsville) want you to do.

- Scan the following (or as many of the following that you have), in colour, onto the one page

- Driver’s Licence OR Proof of Age Card – both front and back

- Medicare Card

- Centrelink Health Care OR Pension Card

- Passport (Optional)

- If you do not have an electric copy of the following documents, scan (in colour) as many of the below documents as possible:

- Phone/Internet Bill – front page only

- Mobile Bill – front page only

- Electricity / Gas Bill – front page only

- Bank Statement – front page only

- Birth Certificate (optional)

- Ensure all documents are clear and easy to read

- Upload to the Identification section of your online application platform.

- Do this for EACH PERSON over 18 years of age

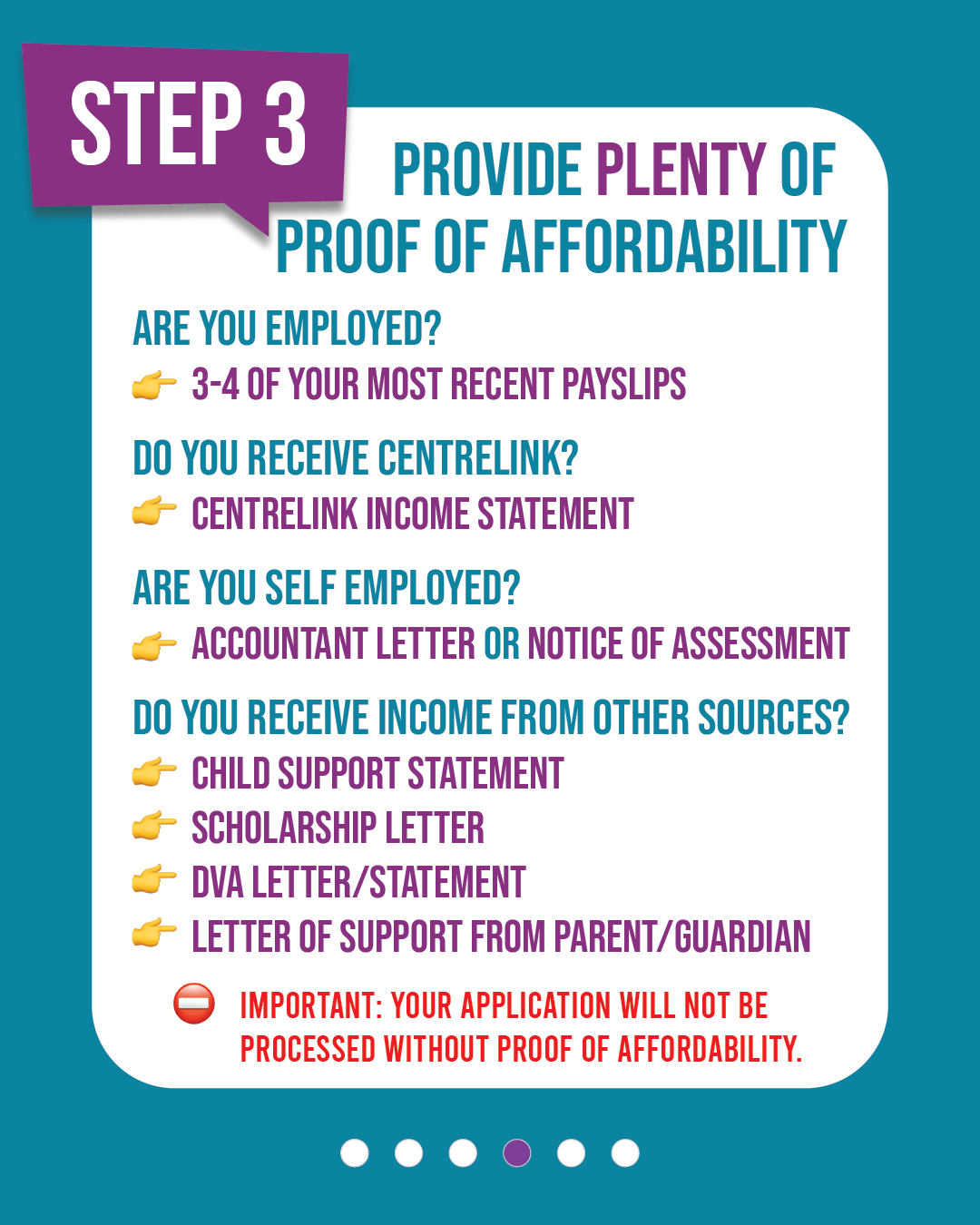

Proof of Affordability

You need to be able to prove that you can afford the property. Unfortunately, this doesn’t include your personal budget and expectations… this comes down to simple math, based on the information you provide with your application.

The documents you are required to provide are based on your circumstances, so we will make it simple by asking you the following questions:

More often than not, a person is able to budget their money in a proactive way that results them being able to afford more than expected. However, when it comes to identifying potential of risk, there is a standard formula that is required to be followed (and this is enforced by Insurance Agencies).

This means 30% of your total household income MUST equal more than the weekly rent amount of the rental property.

The only time that any considerations will be made regarding this, is if you have rented a property at a higher rent amount while maintaining the same lower income, without falling into arrears at any point. This can be verified by your previous agent/landlord and supported with a tenant ledger.

References and Database Checks! Especially rental references with supporting tenant ledgers, and a quick search on TICA.

Proof of Low Risk Tenant

(AKA Ability to meet their lawful obligations)

As much as we want each and every one of our tenant’s to have a happy and safe home that they can enjoy, we need to ensure that you are aware that (as cold and clinical as it sounds) you are entering into a lawful contract and are paying for a service.

Your sole obligation as a tenant is to meet your lawful requirements, as outlined in your tenancy contract. Failure to fulfil these obligations places you in breach of your contract, and the service can be disconnected.

Our job is to ensure that this does not happen, at any time!

Although we are extremely good at what we do, clairvoyance is not one of our skills and our desk isn’t equipped with a crystal ball. So how do we identify which applicants are a low risk? (or a high one)

Bad news, if you are listed on TICA, it’s going to be an instant no. Being listed on TICA identifies that you are not able to meet your obligations in accordance with your contract.

Now – we are not calling people listed on TICA ‘bad tenants’. Sometimes things happen in life that are completely out of our control and result in everything falling apart/exploding in your face.

However, when things like this happen, it is how you react to them and work to fix it that separates a good tenant from a ‘bad’ one. This is the same for during a tenancy – accidents happen, you can slip on wet tiles and put your elbow through the wall… but how you address the matter (and if you fix it correctly) will determine if you’re a good tenant.

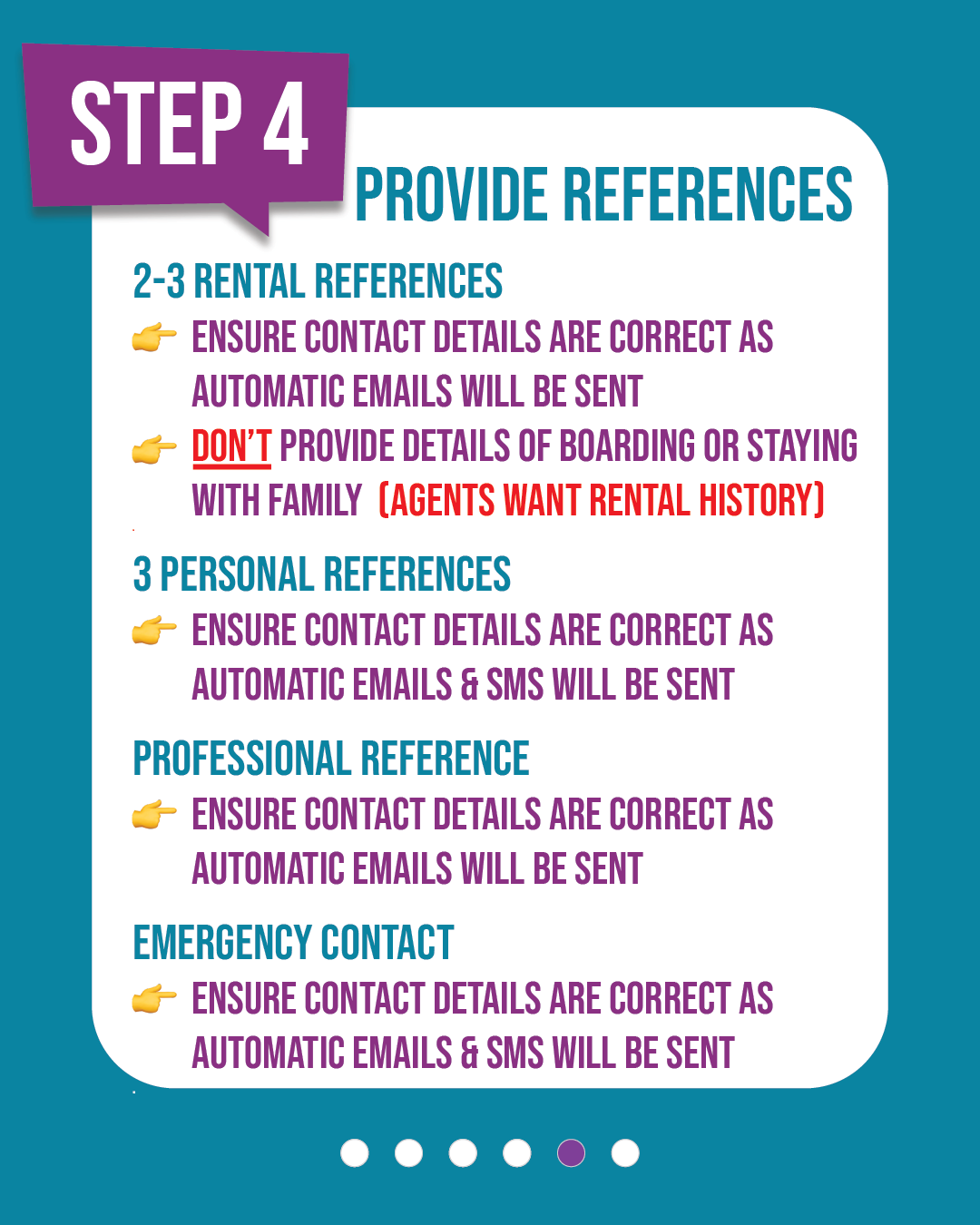

Here is what we want from you on your application:

- 3 personal references and their contact details – be sure to let them know they are a reference and to expect to be contacted by real estate agents. Our system will send them an email or SMS, asking them to fill out a questionnaire.

- Professional References and their contact details – again, be sure to let them know they are a reference and to expect to be contacted by real estate agents. Our system will send them an email, asking them to fill out a questionnaire.

- Rental References for properties you have rented (either through an agent or a private landlord) – if you have been living with family or friends, we don’t want those details. We want to know what rental history you have and how successful it has been. If you provide a rental history of couch surfing and boarding with family and friends, your application probably isn’t going to progress very far. Our system will send them an email or SMS, asking them to fill out a questionnaire.